How to make UPI Payments without Internet

Millions of Indians have made their lives easier with United Payments Interface (UPI). This allows money transfers from one bank account to another via a mobile app. Google Pay, Amazon Pay, Paytm, Airtel Payment Bank, PhonePe, and NPCI’s BHIM enable users to make and accept payments seamlessly.

This all requires an internet connection. However, there might be times when the user is unable to access the internet. Sometimes it can be difficult to pay online. There is an easy way to make a UPI transaction online. This is possible on both basic and smartphones.

How to make UPI Payments without the Internet

Method 1:

It is easy to make UPI payments. Just follow these steps. You will need to use the UPI 123Pay service, available via IVR. To make sure that they are safe, users will need to link their bank accounts and phone number. Continue reading for more information.

- You will first need to dial “08045163666” to initiate the UPI payment process.

- Next, press the ‘1’ key on your phone’s keyboard to transfer money.

- After confirming your details, you will be asked for the bank that has been paired with UPI. To confirm details, users will need to again press the “1” number on their phone’s keypad.

- Tap on “1” again to transfer money. Enter your mobile number and confirm.

- Enter the amount you wish to transfer, and the UPI pin you previously set for transactions

Method 2:

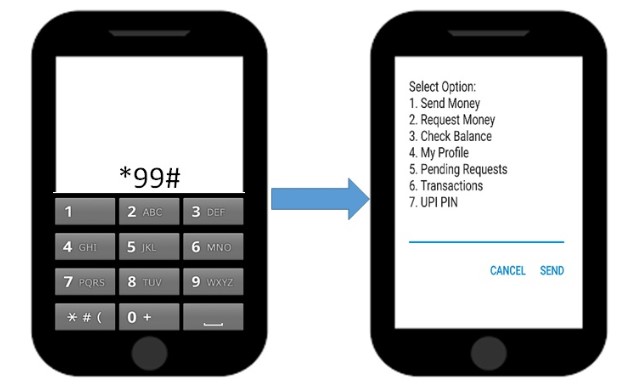

Using *99#

*99# has provided banking services to all citizens, regardless of where they live. In 2012, the USSD-based NPCI was launched. On August 25, 2016, UPI was launched by NPCI with its member banks. It is offered by top-four telecom service providers and 83 banks. Account holders can send and receive money from any bank using a unique id called UPI id (or payment address) without the need for an internet connection. The service is available in 13 languages, making it extremely accessible.

It does not require data connectivity, which makes it a highly accessible service. Users can access the service through a common code *99# that is shared by certain GSM Operators or mobile handsets. Users also get an additional channel to use BHIM app as a key catalyst for financial inclusion

Features of *99# are :

- USSD is the access channel that works across all GSM handsets (smartphones or not), allowing it to reach the last-mile user.

- Menu-based applications are simple to use for users

- It doesn’t require data connectivity, making this a high-availability service.

- Even on holidays, it’s possible to work

- Accessible via a common code *99# between specific GSM Operators or mobile handsets

- Additional channel to use BHIM App and key catalyst for financial inclusionSource: NPCI